Why Most Funded Traders Fail: Insider Insights from the Prop Industry

The rise of proprietary trading firms has changed the landscape for retail traders. With headlines promising six-figure funding, low personal risk, and rapid scaling, prop firms appear to offer a shortcut to professional trading. Yet behind the marketing, a harsh reality exists: the vast majority of funded traders fail, often within weeks of receiving an account and often in the first days of starting their funding challenges.

This isn’t because most traders are “bad” or lack intelligence. As a result, It’s because the prop firm model exposes weaknesses that retail traders can often hide when trading their own money. Drawing from common patterns inside the prop industry, here’s why most funded traders fail and what separates the small minority who succeed.

1. Passing the Challenge ≠ Being a Profitable Trader

One of the biggest misconceptions is that passing a prop firm challenge proves trading skill. In reality, challenges reward short-term performance, not long-term consistency. Basically traders look for quick success.

Most challenges are structured with:

- Tight drawdown limits

- Aggressive profit targets

- Short time horizons

Evidently, this encourages traders to:

- Increase risk per trade

- Overtrade to hit targets quickly

- Abandon their normal strategy

Moreover, many traders pass by taking elevated risk or benefiting from a favorable streak. But once funded, the environment changes. There’s no reset button. The same aggressive behavior that helped pass the challenge now leads straight to a drawdown breach.

Passing is a test of tactics. Staying funded is a test of discipline.

2. Poor Risk Management Is the Silent Killer for funded traders

In fact, inside prop firms, the number one reason traders lose funded accounts is risk mismanagement, not bad entries.

Common issues include:

- Risking too much per trade (1–2% is often too high under prop rules)

- Failing to adjust position size after losses

- Letting one trade violate daily drawdown limits

Prop firm rules magnify small mistakes. A retail trader might survive a -5% day emotionally and financially. A funded trader often cannot—because the account is gone.

Successful funded traders think in terms of survival first, profits second. They aim to stay within the game, knowing opportunities compound over time.

3. Psychological Pressure Changes Everything

Trading with “house money” sounds easier—until it isn’t.

Once funded, traders experience:

- Fear of losing the account

- Pressure to “make the most” of the opportunity

- Overconfidence after early wins

This leads to emotional swings:

- After a loss: revenge trading or forcing setups

- After a win: increasing size and breaking rules

Prop firms unintentionally create a paradox: the more valuable the account feels, the harder it becomes to trade well.

The traders who last are emotionally detached. They treat the funded account like a job with strict procedures—not a lottery ticket.

4. Overtrading to Justify the Account

Another insider truth: many funded traders feel the need to trade every day.

This comes from:

- Guilt about not “using” the account

- The belief that more trades = more profits

- Boredom and screen addiction

But prop firm data consistently shows that overtrading is highly correlated with failure.

Profitable funded traders often:

- Trade only 2–3 days per week

- Skip sessions without high-quality setups

- Accept flat days as part of the process

In prop trading, not losing money is a skill.

5. Strategy Mismatch with Prop Rules

A strategy that works well on a personal account can fail miserably in a prop environment.

Common mismatches include:

- Martingale or recovery systems (often banned implicitly by drawdown rules)

- Wide stop-loss strategies incompatible with daily limits

- Swing trading strategies affected by news or overnight restrictions

Many traders don’t adapt their systems to:

- Max daily loss rules

- Trailing drawdowns

- Consistency requirements

Prop firms reward smooth equity curves, not explosive growth. Strategies must be adjusted accordingly—usually toward lower risk and fewer trades.

6. Ignoring Statistics and Playing “Hope Trading”

Inside the prop industry, one pattern is painfully obvious: most failing traders don’t track their performance properly.

They often:

- Don’t know their true win rate

- Don’t track drawdown by strategy or session

- Don’t review rule violations

Without data, traders rely on hope:

“It’ll turn around this week.”

Funded traders who succeed think like analysts:

- They know their expectancy

- They stop trading strategies that degrade

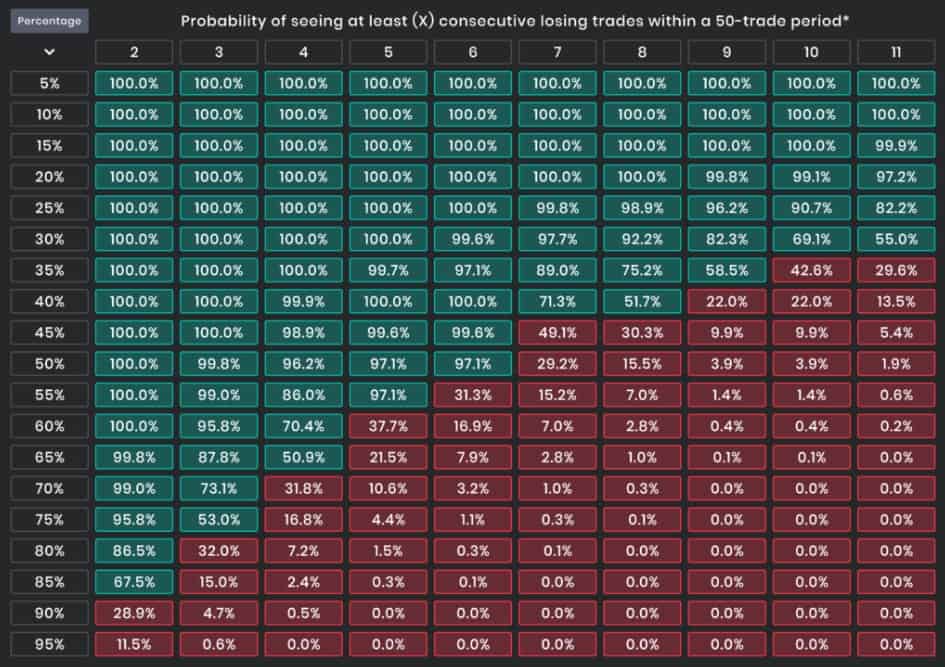

- They reduce size during losing streaks

Hope is not a strategy—data is.

7. Treating Prop Trading as Fast Money

Prop firms market speed: fast challenges, fast payouts, fast scaling. This attracts traders with short-term mindsets.

But the traders who actually make consistent withdrawals think long-term:

- They aim for small monthly returns (2–5%)

- They prioritize account longevity

- They accept slow growth

Ironically, slowing down is often what leads to faster success.

Why a Few Traders Succeed and most fail?

Most funded traders fail not because the system is rigged, but because the environment exposes weaknesses brutally and quickly.

The small percentage who succeed share common traits:

- Obsessive risk control

- Emotional neutrality

- Strategy alignment with prop rules

- Data-driven decision-making

- Patience over excitement

Prop firms don’t reward brilliance. They reward boring consistency.

If you’re pursuing funded trading, the real edge isn’t a secret strategy it’s mastering yourself under pressure. And that’s something no challenge can truly test.