Trading losing streak: Understanding wins and loses distribution

A trading losing streak occurs when a trader experiences a series of consecutive losses. This experience can significantly impact your emotions and mindset. It can lead you to question your strategies and decisions.

For example, seasoned traders often report experiencing several losses in a row, sometimes as severe as five or more. Psychologically, this can be very stressful, as seen in a survey of traders where 70% admitted that prolonged losing streaks affected their mental well-being.

Understanding losing streaks goes beyond crunching numbers. It’s essential for formulating a robust trading strategy. Factors contributing to losing streaks include market volatility, unexpected economic news, or even mere chance. The real skill lies in how you handle and learn from these losses.

How to manage a trading losing streak when it happens

Losing streaks in trading are not a matter of if, but when. Even the best traders with the most proven strategies experience them. What separates successful traders from the rest is how they respond when those inevitable rough patches hit. In this article, we’ll break down practical, psychological, and strategic steps to help you manage a losing streak and come out stronger.

Acknowledge the Streak Without Panic

The first step is to acknowledge the losing streak without overreacting. Emotionally detaching from each trade is key. A few losses don’t mean your strategy is broken or that you’ve lost your edge. What matters is how you respond.

Pro Tip: Keep a trade journal so you can objectively assess if your losses are due to poor decisions, market conditions, or simply variance.

Stop Trading Temporarily

If you’re emotionally affected, pause trading immediately. Trading while frustrated or fearful can cause you to chase losses or abandon your system. Taking a short break can help you regain perspective.

Review Your Trades Objectively

Go back and analyze your last 10–20 trades:

- Did you follow your trading rules?

- Were market conditions unfavorable (e.g., low volatility, news events)?

- Were there any patterns in the losses (e.g., time of day, asset type)?

This kind of review helps separate normal losses from avoidable mistakes.

Reduce Risk Per Trade

During a drawdown, scale down your position size. Risking less preserves capital and helps rebuild confidence. This doesn’t mean abandoning your system—it’s just a way to ease pressure and reduce damage while you regain consistency.

Reaffirm Your Strategy

If your strategy is backtested and has proven long-term profitability, trust it. But if you’ve noticed flaws or shifts in market behavior, consider adapting it without overhauling everything. Be cautious not to strategy-hop based on short-term results.

Work on Your Mindset

Losing streaks test your emotional resilience. Here’s how to stay mentally sharp:

- Meditate or use breathing exercises to manage stress.

- Revisit your trading goals and why you’re doing this.

- Remind yourself that drawdowns are a normal part of trading.

“Trading is 10% strategy, 90% psychology.”

Reconnect With Your Trading Plan

A solid trading plan provides structure. During a losing streak, review your plan and re-commit to following it. You can even simplify it to focus only on your most reliable setups until you regain momentum.

Lean on a Trading Community or Mentor

Talking to other traders can provide encouragement and perspective. You’re not alone—everyone faces setbacks. A mentor or experienced peer can help you pinpoint where you might be going wrong, or reassure you that your strategy is still valid.

Using a Simulator: A Step-by-Step Guide

Step 1: Setting Up the Excel Sheet

Begin by downloading the Win-Loss Simulator Excel template. The layout is user-friendly, with clear fields for data entry. Read through the provided prompts to ensure you’re aware of the settings you can adjust.

Step 2: Inputting Your Parameters

Next, determine the total number of trades to simulate (up to 200). Set your expected win percentage. If you’re feeling confident, perhaps set it to 70%. Once you input these parameters, you’re ready to start the simulation.

Step 3: Analyzing Results

After the simulation runs, carefully review the results. Look closely at the number of winning and losing streaks that appeared. Pay attention to the longest streaks; for example, you might find that over 200 trades, you had a maximum losing streak of 9 trades. This type of data is crucial for assessing your trading strategies.

Coping with Trading Losing Streaks

Experiencing a losing streak can trigger a mix of emotions, including frustration and doubt. Leveraging insights from the simulator can help manage these feelings.

Reflect on Your Strategy: Use the simulator to test various trading strategies. For instance, if you try a different entry point and discover improved results, consider integrating that into your actual trading plan.

Practice Patience: Accepting that losses are a part of trading is fundamental. Research shows that successful traders attribute about 30% of their performance to patience and discipline during tough times.

Adjust Your Mindset: A positive mental shift can help. Viewing losses as lessons rather than setbacks will empower you in future trades.

Real-World Application of Simulation Insights

Trading Psychology

Utilizing the Win-Loss Simulator Excel can deepen your understanding of risk. Knowing the potential for multiple losses in a row can help condition your mindset. For instance, a trader who understands that a three-loss streak is possible may manage their emotional responses better when it happens.

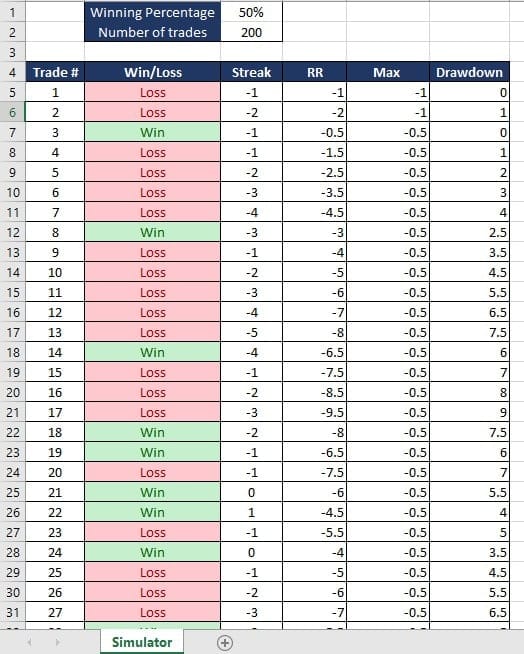

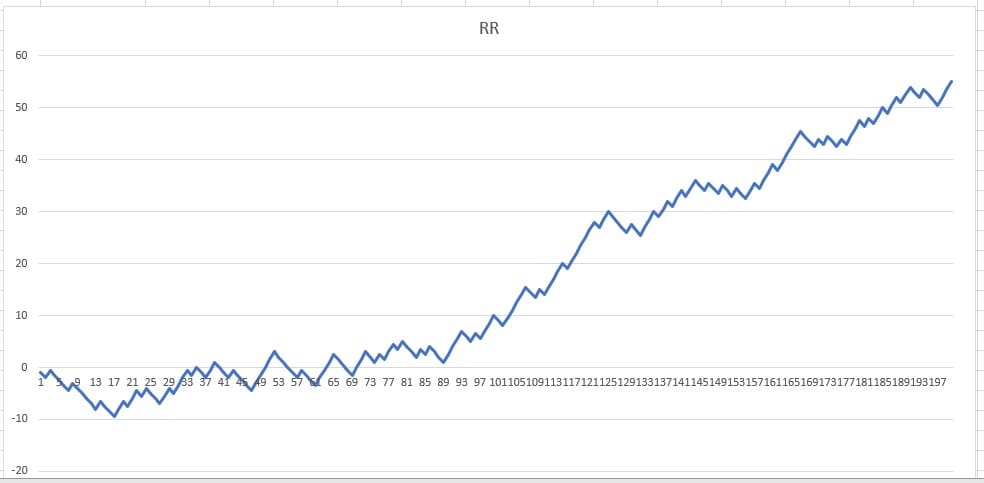

Here I simulated 200 trades for a strategy that has 50% winning rate. As shown in the screenshot, for a 50% winning rate strategy you will be having several loses in a row, most of the time.

Understanding what to expect for your strategy is critical so you can deal with the psychological effects of having a losing streak in trading.

It is important to have in mind always the big picture and do not let loses in a row affect you. Because in the long term, if your strategy has a good risk to reward and good winning rate your equity curve would be increasing slowly. For the 200 simulated trades , see how at the start there was quite a big losing streak with 5 loses in a row, but over time the winners compensated the loses and the equity curve started to point upwards.

Strategy Adjustments

Observing patterns from your simulated trades makes it easier to adjust your strategies. If the emulator shows a possibility of consecutively losing four trades, you may need to rethink your approach to entering and exiting trades.

Gaining Consistency

Running simulations regularly can help reveal ongoing trends. Over time, recognizing these patterns can lead to consistent trading results. For example, a trader who experiences a steady 60% success rate over multiple simulations can better predict their performance.

Common Misconceptions about Losing Streaks

Overemphasis on Luck

A common belief among traders is that losing streaks are only due to luck. In truth, factors such as market analysis, discipline, and strategy play crucial roles. A study indicated that traders who rely on data and insights, rather than hoping for luck, tend to have a 40% higher success rate.

Not All Losing Streaks Are Equal

Some traders worry that long losing streaks undermine their trading skills. In actuality, these streaks often reflect broader market conditions rather than individual talent.

Reflecting on Your Trading Journey

The trading world is filled with uncertainty, but tools like a Win-Loss Simulator Excel can provide clarity and insights. By simulating outcomes and comprehending the potential for losses, you position yourself to make better choices in the market.

Explore how a simulator can reshape your perspective on winning and losing. It could very well be the key to navigating the ups and downs of trading. Happy trading!