Top trading psychology books for prop trading

If you want to take your performance to the next level, here are the top trading psychology books for prop trading. These books will dive into the psychological aspect of how you need to perform to achieve the goals you want and get funded. These are my top 5 recommendations.

Trading psychology books for you to read in 2025

Success in trading often depends less on strategy and more on mindset. While technical analysis and market fundamentals are important, the psychological element of trading can make or break a trader. The best psychology books for trading delve deep into the emotional and mental challenges that come with making high-stakes decisions under pressure.

These books not only teach self-awareness and discipline but also provide frameworks for managing fear, greed, and the inevitable losses that all traders encounter.

Which are the most influencial trading psychology books?

One of the most influential books in this space is Trading in the Zone by Mark Douglas. Douglas emphasizes the importance of thinking in probabilities and shedding the need to be right on every trade. He explores how our deeply held beliefs and mental habits can sabotage performance if left unchecked. By presenting trading as a game of probabilities rather than certainties, Douglas helps traders shift their mindset to one of acceptance and confidence, even in the face of uncertainty. His insights are especially valuable for traders who struggle with consistency or find themselves repeatedly making impulsive decisions.

Another essential read is The Psychology of Trading by Brett Steenbarger. As both a trading coach and a clinical psychologist, Steenbarger blends psychological principles with real-world trading experiences. His book is filled with case studies that show how emotional reactions, self-sabotaging behaviors, and personal biases can affect decision-making. What makes his work stand out is the emphasis on self-reflection. He doesn’t offer one-size-fits-all solutions but instead encourages traders to understand their own emotional patterns and how these play out in their trading behavior.

Are they really helpful for traders?

For those looking to grow not just as traders but as individuals, this book offers a path of personal transformation through trading.

A different but equally powerful perspective is offered in The Daily Trading Coach, also by Steenbarger. This book serves as a practical guide, offering 101 lessons that traders can use as daily exercises to improve their psychological resilience. From managing stress to cultivating optimism, the book gives traders a toolbox to stay mentally sharp and emotionally balanced. It’s ideal for those who want something hands-on and applicable, especially during challenging periods in the market.

Performance helpers

Then there’s Enhancing Trader Performance, also authored by Steenbarger, which dives into the idea that trading excellence, like athletic or artistic performance, can be trained and improved through deliberate practice. This book helps traders think like elite performers, focusing on repetition, feedback, and continuous improvement. It breaks down how traders can develop expertise and improve decision-making over time through focused mental conditioning.

Together, the top trading psychology books reveal that trading is less about finding the perfect strategy and more about mastering oneself. The market will always be unpredictable, but the trader’s response to it can be disciplined, rational, and composed. These psychological insights don’t just help with trading—they foster emotional intelligence, patience, and the kind of clarity that benefits every area of life. Whether you’re a novice or an experienced trader, investing in your mindset through these books may be the most profitable trade you’ll ever make.

Top psychology books you can read that will help you in prop trading.

It is always about your mental state. If you are willing to be discipline and patient, you will be 90% ahead of people who lose money in the markets. Remember that its more about your psychology that your trading strategy. So lets dive in the best books we recommend you reading to achieve that state of mind. These prop trading

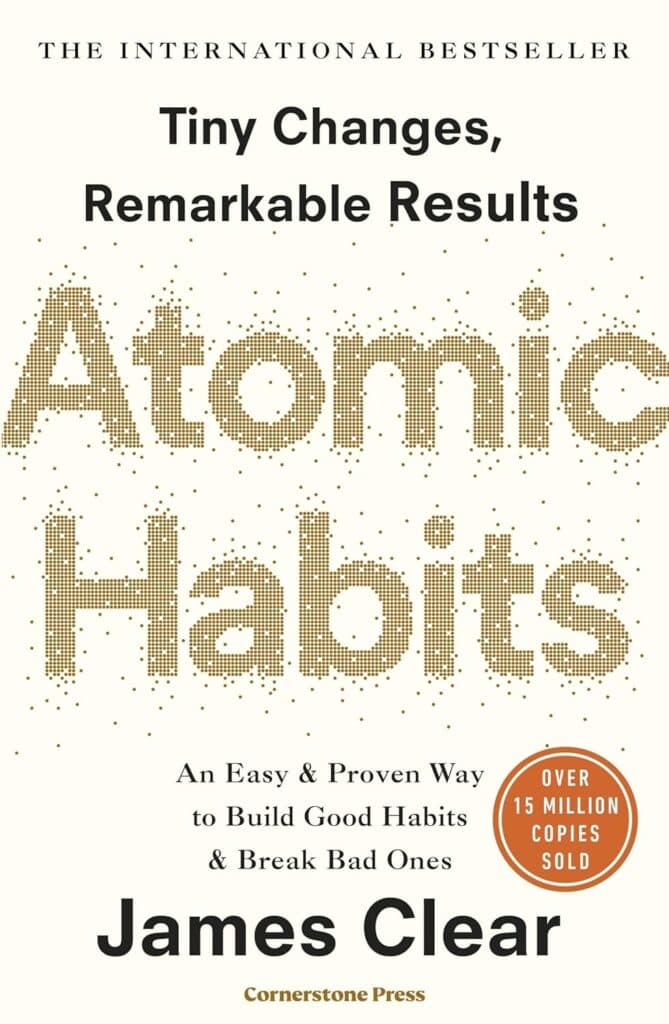

#1 ATOMIC HABITS

THE PHENOMENAL INTERNATIONAL BESTSELLER – 1 MILLION COPIES SOLD

Transform your life with tiny changes in behavior, starting now.

People think that when you want to change your life, you need to think big. But world-renowned habits expert James Clear has discovered another way. He knows that real change comes from the compound effect of hundreds of small decisions: doing two push-ups a day, waking up five minutes early, or holding a single short phone call.

He calls them atomic habits.

In this ground-breaking book, Clears reveals exactly how these minuscule changes can grow into such life-altering outcomes. He uncovers a handful of simple life hacks (the forgotten art of Habit Stacking, the unexpected power of the Two Minute Rule, or the trick to entering the Goldilocks Zone), and delves into cutting-edge psychology and neuroscience to explain why they matter.

Along the way, he tells inspiring stories of Olympic gold medalists, leading CEOs, and distinguished scientists who have used the science of tiny habits to stay productive, motivated, and happy.

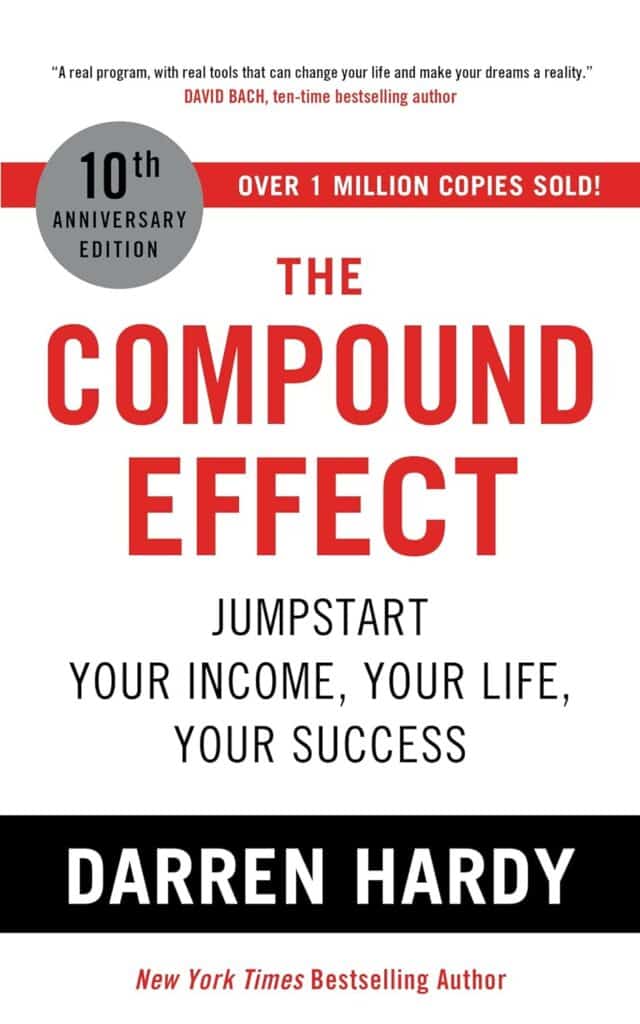

#2 THE COMPOUND EFFECT

As the central curator of the success media industry for over 25 years. Darren Hardy has heard it all, seen it all, and tried most of it. This book reveals the core principles that drive success. The Compound Effect contains the essence of what every super achiever needs to know, practice, and master to obtain extraordinary success. Inside you will find strategies on:

How to win–every time! The No. 1 strategy to achieve any goal and triumph over any competitor, even if they’re smarter, more talented or more experienced. Eradicating your bad habits (some you might be unaware of!) that are derailing your progress. Painlessly installing the few key disciplines required for major breakthroughs. The real, lasting keys to motivation–how to get yourself to do things you don’t feel like doing. Capturing the elusive, awesome force of momentum. Catch this, and you’ll be unstoppable. The acceleration secrets of super achievers. Do they have an unfair advantage? Yes, they do, and now you can too!

If you’re serious about living an extraordinary life, use the power of The Compound Effect to create the success you desire. Begin your journey today!

Loads of concepts that are in this book are directly applicable to trading psychology.

#3 THE POWER OF NOW

The essential companion volume to the phenomenal self-help bestseller THE POWER OF NOW – ‘the must-read bible du jour’.

Eckhart Tolle’s book describes the experience of heightened consciousness that radically transformed his life – and shows how by living in the moment we can also reach a higher state of being where we can find joy and peace and where problems do not exist.

The invaluable companion volume – PRACTISING THE POWER OF NOW – contains all the essential techniques we need to start to put this important book into practice in our own lives. No reader will be complete without it.

This book definitely deserves a spot in the top trading psychology books.

#4 THE PSYCHOLOGY OF MONEY

“The Psychology of Money” by Morgan Housel explores how our emotions and beliefs significantly influence our financial decisions, often more than logic or mathematical calculations. Through engaging stories, Housel reveals that success with money isn’t solely about what you know, but more about how you behave.

The book highlights several key ideas:

- No one is crazy: Everyone has a unique perspective on money shaped by their personal history and experiences. What seems irrational to one person can make perfect sense to another based on their background.

- Luck and risk are inseparable: External factors play a much larger role in financial outcomes than we often acknowledge. Success isn’t always solely the result of hard work, and failure isn’t always due to poor choices.

- Enough is a moving target: The hardest financial skill is knowing when you have enough. Social comparison and constantly rising expectations can lead to taking unnecessary risks, preventing true contentment.

- Compounding is powerful but requires time: True wealth building relies on the magic of compounding, which takes patience and the ability to stick around for the long term.

- Getting wealthy is different from staying wealthy: Building wealth requires optimism and risk-taking, while preserving it demands frugality and a degree of paranoia about potential losses.

- The importance of a high savings rate: Building wealth is less about income and more about how much you save. A high savings rate provides flexibility and security.

- Understanding your own time horizon: Financial decisions should align with your personal long-term goals, not based on the actions of those with different timelines.

- The value of independence and control: One of the highest returns of money is the ability it gives you to control your time and have more autonomy in life.

- Wealth is what you don’t see: True wealth is often hidden – it’s the income not spent, representing options and flexibility for the future, rather than flashy possessions.

- Plan for things not going according to plan: A crucial aspect of financial planning is to build in a margin of safety and prepare for unexpected events.

Ultimately, “The Psychology of Money” emphasizes that understanding our own psychological biases and adopting sensible, long-term perspectives are essential for building wealth and achieving financial well-being.

It’s a reminder that managing money effectively is more of a soft skill rooted in behavior than a hard science based on numbers.

#4 TRADING IN THE ZONE

This is another jewel for the top psychology trading books. The main contents of Trading in the Zone is dedicated to one goal — becoming a consistently successful trader. According to Mark Douglas, it is a big mistake of the majority aspiring traders does it all wrong by studying the market’s behavior rather than starting looking into one’s own mind and traits. There are five “fundamental truths” about the market at the core of the “right” trading mind-set:

- Anything can happen.

- You do not need to know what will happen to earn money.

- The distribution of winning and losing trades is random.

- An edge means only a higher probability of a winning trade compared to a losing one.

- Every instance of the market is unique.

Anything can happen means that the market is composed of traders and there is no way any of the traders can know with certainty what the other one is going to do. Even if some technical, fundamental, or sentiment indicators strongly forecast some movement, the real outcome could be completely different as it may take only one trader to affect the prices.