How to Start Trading with Prop Firms: A Detailed Guide

Trading with prop firms (short for proprietary trading firms) has become one of the most attractive ways for retail traders to access large capital, accelerate growth, and establish a professional trading career—without risking their own funds. But how exactly does one get started?

In this comprehensive guide, you’ll learn everything you need to know to begin trading with prop firms, including what they are, how they work, how to pass evaluations, and how to increase your chances of long-term success.

What Is a Prop Firm?

A proprietary trading firm is a company that gives traders access to its capital to trade financial markets—such as forex, indices, commodities, or stocks—in exchange for a share of the profits. Instead of risking your personal capital, you trade with the firm’s funds. To understand in detailed what a prop firm is visit my article what i

The deal:

- You pass a challenge or evaluation to prove you can manage risk and stay profitable.

- The firm provides a funded account.

- You get to keep a portion of the profits (commonly 70% to 90%), while the firm keeps the rest.

Benefits of Trading with Prop Firms

- Access to Large Capital:

Most firms offer accounts ranging from $10,000 to over $1,000,000. - Low Risk to You:

You’re trading their capital—not yours. If you lose, you don’t owe them money (as long as you follow the rules). - Accelerated Trading Career:

You get a “job” as a trader without needing a degree or working at a financial institution. - Payouts for Profitable Traders:

Once funded, you can receive payouts as often as every two weeks or monthly. - Scalability:

Many firms allow scaling plans that increase your account size as you grow.

Step-by-Step: How to Start Trading with Prop Firms

Step 1: Understand the Prop Firm Business Model

Prop firms operate on two main models:

- Challenge-Based Prop Firms (Retail-Oriented)

Examples: FTMO, MyForexFunds (prior to closure), FundedNext, The5ers- Traders pay a fee to take a challenge.

- Must prove consistent and safe trading.

- Get funded if the evaluation is passed.

- In-House Desk or Hiring Model (Institutional-Oriented)

Examples: Jane Street, Jump Trading, DRW- Interview-based recruitment.

- Offers salary + performance bonuses.

- Requires in-office work and advanced math/programming skills.

This guide focuses on challenge-based firms—ideal for independent forex or futures traders.

Step 2: Choose the Right Prop Firm

Before paying for a challenge, research these key areas:

🔒 Trust & Reputation

- Read Trustpilot reviews, Reddit threads, and YouTube testimonials.

- Verify payout history and longevity of the firm.

📜 Trading Rules

Check rules like:

- Max daily loss (e.g., 5%)

- Max overall loss (e.g., 10%)

- Trading time restrictions

- Lot size limits

- Holding trades overnight/weekends

💰 Profit Split & Payout Schedule

- Most firms offer 70%–90% of profits to traders.

- Confirm payout frequency (biweekly or monthly).

⚖️ Trading Conditions

- Spread quality

- Leverage offered (e.g., 1:30 to 1:100)

- Execution speed

- Broker used (some use in-house brokers, others use external ones)

💵 Cost of Challenge

Challenges typically cost $100–$1,000 depending on account size. Some firms offer refunds after passing.

Popular Prop Firms in 2025:

Step 3: Pass the Evaluation Challenge

Most firms use a 2-phase evaluation process:

📈 Phase 1: Profit Target with Risk Limits

- Profit target: ~10%

- Max daily loss: 5%

- Max overall loss: 10%

- Time limit: Usually 30 days

📉 Phase 2: Lower Profit Target, Same Risk Rules

- Profit target: ~5%

- Max drawdown rules remain

- Usually has no time minimum

✅ After passing both, you’re funded!

Tips to Pass:

- Trade a proven strategy with strict risk management.

- Risk 0.5%–1% per trade to protect your drawdown.

- Avoid news spikes unless part of your strategy.

- Trade only high-probability setups.

Step 4: Get Funded and Start Trading Real Capital

Once funded, you’ll receive login details to a real or simulated live account (most use demo accounts with real-time simulation and real payouts).

Key Considerations:

- Trade within the rules or you’ll lose funding.

- Request payouts according to the firm’s schedule.

- Track performance to identify strengths and weaknesses.

Step 5: Stay Consistently Funded

Getting funded is just the beginning. Staying funded and consistently profitable is where most traders struggle.

Tips for Long-Term Success:

- Stick to one or two proven setups.

- Avoid overtrading during drawdowns.

- Keep a journal for each trade: entry, exit, reason, emotion.

- Withdraw profits regularly.

- Never revenge trade to recover losses.

- Take breaks when needed—trading is a marathon.

💼 Prop Firm Myths Debunked

❌ Myth 1: Prop firms are scams.

Many are legitimate and pay out regularly. But due diligence is key. That is why only buy challenges from prop firms listed here

❌ Myth 2: You need to be perfect to pass.

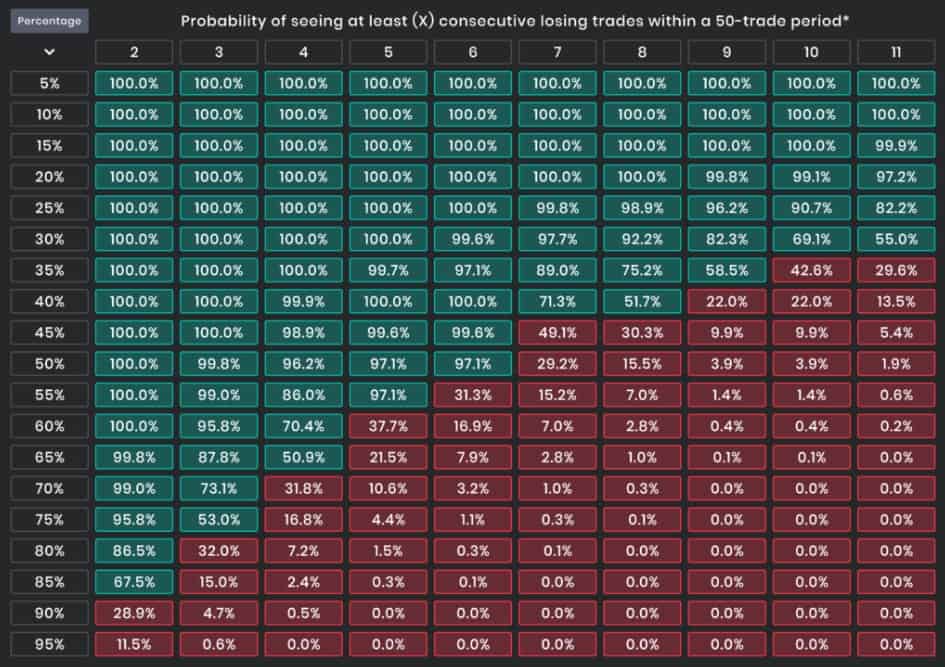

You just need to be consistent and manage risk well. Even 40–60% win rates can pass.

❌ Myth 3: Prop firms are for day traders only.

Many support swing traders, scalpers, and even news traders—just pick the right firm. Check our page best prop firms swing traders

📊 Realistic Expectations

- Success Rate: Only about 5%–10% of traders pass and maintain funding long-term.

- Income Potential: Varies—some earn $500/month, others make $10,000+.

- Time Commitment: Part-time to full-time, depending on your trading style.

🧰 Tools to Help You Succeed

- Trading Journal: Edgewonk, MyFXBook, or Google Sheets

- Risk Calculator: Myfxbook Position Size Calculator or MT4 scripts

- Economic Calendar: Forex Factory or Trading Economics

- Backtesting Tools: Forex Tester, TradingView replay, or manual logs

📈 Scaling Plans & Career Growth

Some firms offer scaling programs that:

- Increase capital after hitting profit milestones.

- Allow multiple funded accounts (e.g., up to $400k).

- Offer private funding or salary-based roles.

You can eventually manage 6–7 figures in capital with good performance.

📝 Final Thoughts: Should You Try Prop Trading?

Trading with prop firms is one of the most accessible ways to enter the world of professional trading without the need for massive capital or credentials. If you have a solid strategy, emotional discipline, and risk management, it’s a fantastic way to turn your trading skills into real income.

However, it’s not a shortcut to riches. Treat it like a business. Develop a process, be patient, and focus on consistency over excitement.

💡 Ready to Get Started?

- Backtest your strategy thoroughly.

- Choose a prop firm with fair rules and payouts.

- Apply and take the challenge.

- Trade with discipline and confidence.

👉 If you want a free trading journal, checklist, and tools to help you pass your next prop firm challenge, download this free toolkit .