Trading plan – How to create one for profitable higher returns

Creating a solid and profitable financial trading plan involves detailed planning, disciplined execution, and continuous learning. If you are aiming to pass a prop firm challenge, it is necessary that you have a trading plan that you can follow rigorously. Here’s a step-by-step tutorial to guide you through the process:

Steps for a Profitable Trading Plan.

Step 1: Define Your Trading Goals

It is important that you write down the biggest motivation behind trading. Either it is freedom or being able to improve your life, that is the main objective that will give you strength to works towards consistency and patience.

Identify Your Objectives in your plan

- Short-term Goals: Why you want to trade.

- Long-term Goals: Building wealth over time, retirement planning.

Set Realistic Expectations

- Understand the potential risks and rewards.

- Avoid unrealistic profit expectations. A realistic expectation would be around 40% – 80% per year.

- Keep in mind that not all months are positive.

Step 2: Choose Your Trading Style

When creating you trading plan is crucial to define what type of trader you are. If you are less patience probably the longer timeframes are not the best option for you. Instead choose a trading style that fits your personality, that will help you control your emotions and will get you closer to get you funded.

Determine Your Trading Timeframes

- Day Trading: Buying and selling within the same day.

- Swing Trading: Holding positions for several days or weeks.

- Position Trading: Long-term holding, spanning months or years.

Match Trading Style to Your Personality

- Consider your risk tolerance, available time, and market knowledge. This is the defining how much you will risk per trade or how many trades are you taking in a week.

Step 3: Conduct Market Research

It is important to be informed when trading. We recommend that you use an economic calendar so you will be updated with the latest economic releases and economic news that are happening around the world.

Study Market Fundamentals

- Economic Indicators: GDP, employment rates, inflation.

- Company Analysis: Financial statements, earnings reports. (For Stocks)

Analyze Technical Indicators

- Price Charts: Candlestick patterns, trend lines, support and resistance.

- Indicators: Moving averages, RSI, MACD.

Step 4: Develop a Trading Strategy

When developing your strategy the best way to do it is trough defining very black and white conditions. This way your trading approach is very mechanical so you can avoid subjective analysis and therefore have better consistency.

Define Entry and Exit Pointsin your trading plan

- Entry Criteria: Conditions under which you will enter a trade.

- Exit Criteria: Conditions for taking profits or cutting losses.

Risk Management Rules

- Position Sizing: Determine how much to trade per position. Check out our Position Size Calculator.

- Stop-Loss Orders: Predefine the maximum loss you can tolerate.

- Take-Profit Orders: Set profit targets to lock in gains.

Step 5: Create a Trading Plan Document

After you have selected all your conditions and criteria, it is crucial to write down all the rules you defined. It can be in a way of a checklist or a word document, it’s up to you. The take away here its that you have something that you can always refer to, making sure you are committing to your plan.

Outline Your Strategy

- Market Analysis: Summary of fundamental and technical analysis.

- Trading Rules: Clear entry, exit, and risk management rules. These rules need to be as mechanical as possible to avoid undesired emotions.

Define Your Goals and Objectives

- Financial Targets: Specific profit goals and timelines.

- Performance Metrics: How you will measure success. Its crucial that you keep all your metrics in one dashboard. My trading Journal template offers a dashboard you can customize.

Step 6: Backtest Your Strategy

At this point you have everything outlined. Now its time to test your trading plan. One of the best things you can do it’s to backtest your trading strategy. Make sure you do not spend to much time on this point, remember that historical results do not mean necessarily that they will repeat.

Historical Data Testing

- Apply your strategy to historical market data to see how it would have performed. This can be done in Trading View or MT4

Analyze Backtest Results

- Evaluate profitability, drawdowns, win/loss ratio, and other key metrics.

- For backtesting, I recommend you use the Premium features from Trading View,

- You will be able to replay bars and simulate your trades with historical data.

Step 7: Start Trading

Choose a Prop Firm or Broker

- Select a reputable prop firm or if you decide to trade with a prop firm, choose a trusted Prop Firm that that offers the tools and support you need. More information in my Prop Firm Review.

Buy and Start your challenge

- Buy a prop firm challenge to get funding. It is important that you buy the right Prop Firm challenge for you. To see different challenges, check out our trusted Prop firms.

Paper Trading

- Practice with a demo account to refine your strategy without risking real money. Some Prop Firms allows you to have free trial without spending any money. Check FTMO review for more info

Step 8: Monitor and Review

Once you start trading you trading plan, it is very important that you track all your stats. The advantages of trading with a prop firm is that prop firms offer an out of the box metric dashboard that tracks all your trades, so do no need to worry. One of the best trading metrics dashboard we have found is with Alpha Capital prop firm.

Track Your Trades

- Keep a detailed trading journal of all your trades, including reasons for entering and exiting positions. Enter your email and you will get a Trading Journal template completely free.

Review Performance Regularly

- Analyze your trading results periodically to identify strengths and weaknesses.

Give it at least 4 months for a strategy to work. Be patient and stick to your plan.

Step 9: Adapt and Improve

You have been trading for a while at this point, and its time to do some adjustments. That is why keeping a journal of all your trades is key so you can detect the things that are not working for you and the things you need to be do more of.

Plan your trading for Continuous Learning

- Stay updated with market news, new trading strategies, and techniques.

- Attend webinars, read books, and join trading communities.

Adjust Your trading Plan as Needed

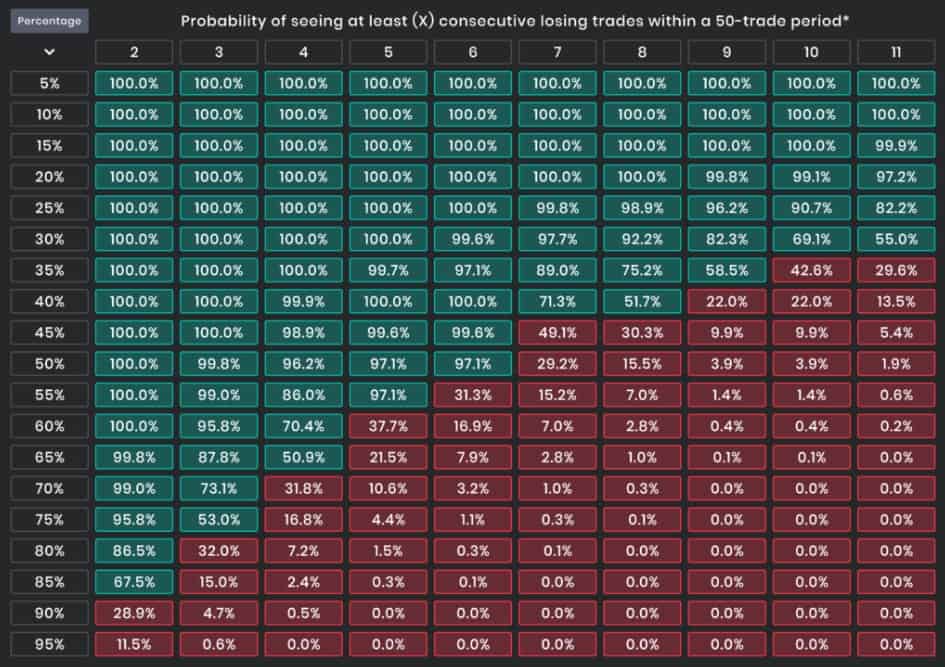

- Make necessary adjustments to your strategy based on your own data, performance reviews and market changes. But remember do not change you strategy if you don’t give it time. Strategies are not perfect an eventually you will have a drawdown period. Check our Drawdown Calculator

Example of a Trading Plan – Template

Here’s a trading template framework example that you can customize and adapt to your own needs and personality. Remember that a trading plan is very personal and if you find yourself copying one online for sure it wont work. Put in the work and work on your own, that is the best advice I can give you.

By following these steps and creating a detailed trading plan, you can increase your chances of achieving consistent profitability in getting funded by a prop firm!.